L0la L33tz

L0la L33tz

Independent Journalist. Bylines in too many places. "Anonymous Internet Commentator" –US Department of Justice. Privacy is not a crime.

💜 https://primal.net/therage

💌 DMs via email only: lola@therage.co

therage.co

L0la L33tz

11/16 21:16:59

💕

My guys. The email that this person is quoting here is photoshopped. It is not real.

Below is the real email from the Epstein estate. There is no mention of Satoshi.

Someone circulated the photoshopped version on X, Grok picked it up and told people that Epstein met with Satoshi, which then led to these claims going viral.

The absolute state of things in this space is that people will tell you not to believe the media and then blanketly repeat what an AI tells them.

Someone put me out of my misery.

nostr:nevent1qvzqqqqqqypzpyezhkfz7gxxlnv7jy69gunm8w7z6zttujq3jug9t2pxmk3afjctqqs2n7ar7jmaqlup52hfpd9p4wl2m76xnxuxndpepdagl00k7t6ju6g9mvtzu

⬆

a9fba3f4b7d07f81a2ae90b4a1abbeadfb4699b869b4390b7a8fbdf6f2f52e69

L0la L33tz

8/14 3:11:32

💕

Wake up motherfuckers, if you thought it couldnt get any worse, it just did:

Google Play Store is banning all non-custodial wallets whose developers do not have a FinCEN registration, state banking license, or MiCA license.

This means that in the US, *all* non-custodial wallets on the Play Store will have to employ AML/KYC.

Sounds bad? In the EU, it’s even worse:

MiCA licenses are not issued to services as simple as non-custodial wallets, effectively banning non-custodial wallet developers from the Play Store in the EU.

As with all dumb AML ideas, it’s of course the FATF that opened the door to this nonsense, claiming that even non-custodial/decentralized software could have some element of control over funds.

The DOJ tried to enforce this quagmire with Samourai and Tornado Cash, and now we’re seeing the largest App Store in the world enforce it on its own.

After regulation by prosecution, here comes regulation by monopoly

Are you tired of winning yet?

nostr:note1dkrcd6n2za8mswtr3fs8g2ncz688v38putrq595q7w8yxpt3zpusgmhjdj

L0la L33tz

7/18 0:38:07

💕

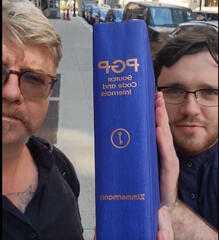

20 years ago, the US Government tried to make the contents of this book illegal.

Today, it inspired the development of almost every encrypted app we use, from Signal to email and VPNs.

They lost then, and they will lose again now.

nostr:note1qk6fwygda5asgp6w8dme300z4m0gtju4mhegc0jwn9wl6vq8avvq82wstc

L0la L33tz

4/23 4:00:23

💕🤙

Please raise your hand if you think appointing a former FTX advisor as head of the SEC is a good idea so I can unfollow you

L0la L33tz

1/28 3:28:55

💕🤙

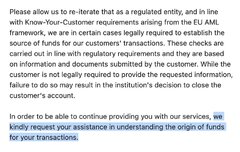

Another day, another exchange I am suspended from.

All of my funds are conjoined or swapped between LN/XMR for privacy before sending to exchanges, triggering all sorts of nonsense AML flags.

The exchange I am with now is requesting proof of funds, meaning it wants to see fiat coming into my bank account from an entity I have a business relationship with, asking me to "kindly assist them" in surveilling me.

Except that all of my business relationships are handled in bitcoin – meaning that it is impossible for me to show proof of fiat funds.

Alternatively, the exchange says, I could send them “the address” to which I received payment in the last year, matching the amount of money I have exchanged on their platform.

Obviously no such address exists as I create a new address for each transaction (and so should you). Additionally, much of my money comes in through donations, for which I simply do not have an invoice.

I could now send them every single zap I ever received on nostr in the past year – for context, that would be over 250 zaps in the past week alone, s/o to all the zappers – or I could move my business to Switzerland, where I can exchange up to 1000 CHF per day KYC-free (for now), which is what I’m going to do.

However, since I’ll be more heavily relying on peer-to-peer exchanges from now on, I’ll likely have my bank account flagged for receiving weekly payments from randos on the internet, making it fairly foreseeable that I’ll be losing my bank account in the coming months as well.

Fundamental rights violations aside, the amount of complete nonsense work – and with that costs – this system creates both for the Government and private institutions is absolutely astonishing. If there ever was a true bullshit job, compliance officer would no doubt be it.

It’s time we end the global discrimination complex inherent to the financial system in which we are all guilty until proven innocent, only to upkeep an inefficient system that is useless in preventing crime but formidable for imposing mass surveillance on the people.

So no, I will not "kindly assist you" in surveilling me, and if I die on this hill.

Until then, shill me your favorite tools to pay my bills in bitcoin 👇

L0la L33tz

1/24 2:12:19

💕

GM, the internet says Bhutan is coinjoining

Based if true

https://www.msn.com/en-us/money/markets/royal-government-of-bhutan-once-again-moves-bitcoin-btc-through-anonymous-addresses/ar-AA1xnoFw

L0la L33tz

12/18 5:16:38

💕🤙

David Bailey just posted the draft for an executive order for the Bitcoin Strategic Reserve under Trump – and it's an absolute nightmare for anyone using bitcoin as money.

First, the draft order defines Bitcoin as "a finite store-of-value asset, akin to digital gold."

As someone who has lived on Bitcoin for a fairly long time, I can say that Bitcoin is not merely a "store-of-value asset", but a money for payment and day to day purchases.

Defining Bitcoin as a "store-of-value asset" reinforces the ossification narrative (who needs to move a stonk several times in a day?) which may put developers at risk when prioritizing changes to btc to make it more usable as money (think scaling for example).

With this definition, a softfork to activate covenants may become an issue of US national security that goes against the US' definition of its primary goals - directly putting developers in the firing line of the United States Government.

The draft states that federal agencies, such as the US Marshall's Service, may not auction seized Bitcoin off, but must contribute them to the strategic reserve.

This not only reduces the Bitcoin in circulation available to the public, but additionally sets the incentive for the US to increase its seizing efforts – think increased AML/KYC.

While I'm no fan of the strategic reserve in general, this draft is an even bigger disappointment than Sen. Lummis' proposed Bitcoin Act.

To compare this to how El Salvador has implemented Bitcoin, which I admit I initially wasn't a fan of either, ES directly gives citizens rights to use Bitcoin as money - which is a huge upside to benefit the people, and not just the national security state.

No offense, but letting a couple of children that just graduated college and a guy who runs a magazine draft US policy is a scene straight out of idiocracy.

Next time, maybe try speaking to the people actually building and using bitcoin, not just to the boomers and national security goons that sit on the money like a fat kid at the cake buffet.

Incredibly unprofessional conduct here by BPI, a huge risk to anyone using Bitcoin for anything other than an investment, and a testament to the people involved being more interested in furthering their own importance than to empower people with a money without state.

Sincerely hope that this EO is drastically challenged on all levels and hopefully somehow deemed unconstitutional to protect btc and the people developing it.