Lyn Alden

Lyn Alden

Founder of Lyn Alden Investment Strategy. Partner at Ego Death Capital. Finance/Engineering blended background.

https://www.lynalden.com/

Lyn Alden

11/17 1:18:54

💕

What if humanity could find some alien tech and thus greatly accelerate its own technological progress? But what if that tech was hoarded by a small group of people?

Anyway, here's a review of Theft of Fire by Devon Eriksen. It's a 22nd century hard science space opera set in our solar system, written by a retired engineer. One of the more successful indie sci fi books in recent years. It's also one of the most successful books to have bitcoin in it; it's a small background role, but bitcoin is one of the leading types of money in the solar system.

Marcus, an indebted down-on-his-luck asteroid miner (and secretly, a bit of a space pirate as of late, given how bad things have gotten) finds his ship taken over by a wealthy genetically modified corporate heiress named Miranda. She has bought his defaulting debt contract that his ship collateralizes, and has gained admin access over his ship's computer. And she knows he is secretly a space pirate, which altogether gives her multiple types of leverage over him. She wants him to take her on a mission to the edge of the solar system to do something she won't say, involving unimaginable treasure, and he has little choice but to go along with it. Secretly, however, he plots how to regain control of his ship as they go, because he recognizes how much of a suicide mission it is because of who guards the space out there.

Pros:

-The hard scientific realism in the book is great. The type that basically takes an engineer to write. No wonder he has endorsements from like, the co-founder of Autocad and such. It's also a smooth read, all from Marcus's perspective.

-Although the story mostly takes place on one ship with a few characters, the worldbuilding is a solid start. I assume it'll be expanded later in the series. The technological situation and structure of society are very fleshed out relative to how little we actually see, given the tight setting. The world feels realistic and lived-in.

-High nostalgia factor. Fans of Firefly and Cowboy Bebop, and more recently the Expanse, and all sorts of classic sci fi literature over decades, will find a lot of references or similarities in a good way. The author is very well-read on the genre.

-The audiobook is pretty unique and great. Unlike most audiobooks, it has a full-cast production, meaning that each line of dialogue sounds like the person speaking it, rather than just one person reading a given chapter's narration and dialogue. I listened to this one rather than read it. You can only buy the audiobook on the author's website though, not Amazon/Audible. (Amazon/Audible have been kind of shitty to authors lately.) The other version of the book are available on Amazon.

-AI gets a really good treatment here, and the third main character, an AI, is my favorite character in the book.

-There's a lot of suspense throughout. Most of it is not really predictable how it's going to end since it doesn't follow a basic tropey structure. Even if you don't particularly like some of the characters (and indeed they're designed to be rather unlikable), you're likely to find yourself reading further to see what happens.

Cons:

-The book is about 500 pages, and I think 50+ could have been cut out of the middle to make it stronger. The dialogue between Marcus and Miranda gets rather repetitive after a while. And because of the limited setting (mostly on one ship), most of the worldbuilding is done via exposition by Marcus. So if readers hate "info dumps", they'll probably get annoyed at this. I personally don't really mind exposition as long as it's good, so this wasn't a dealbreaker for me (the "don't do exposition!" advice to authors is overdone in my view). I just think the middle could have used a trim. And although most of the book is not predictable, one aspect imo very much is, and that's where a lot of the repetition is.

-There are some unnerving aspects/scenes in it. I can't really say what they are without spoilers. Let's just say being in Marcus's head for 500 pages isn't, uh, my cup of tea. The book is self-aware about it, though. It's an intentional choice to have put these unnerving aspects in, so it's not a con per se but it's more something that will put off some readers. And it's a little more understandable by the end.

Overall, a unique story. And for the audiobook, I do think that over time more audiobooks will be made with this more complete type of cast. Audiobooks used to be very expensive and a small piece of the market, and only in recent years have they become very popular. As they become a bigger and bigger share of the fiction market up to some substantial percentage, I think more work will go into their quality and details.

Lyn Alden

11/15 0:13:05

💕

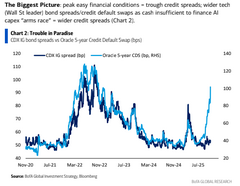

The bond market has been getting a bit nervous about companies with a lot of AI capex ahead. Chart via BofA.

Lyn Alden

10/17 10:40:42

💕🤙

A giant explosion went off at a military base in Cairo. Five killed. Media reports about it are pretty much suppressed- it’s probably an accident but could technically be some sort of terrorist strike as well. Tragic either way.

But what is crazy to me is that the blast was powerful enough to break one of the windows of my house many miles away. It’s crazy how powerful big explosions like this can be.

Lyn Alden

8/7 0:17:31

💕

A big conservative political podcast (seven figure YouTube subscribers) asked me to come on and talk about bitcoin (sat next to them on the plane out of the May conference in Vegas, which sparked their request).

Last week when I went on the show, they decided to emphasize a talking point of why tariffs are great and will usher in a golden age, and some questions about bitcoin.

When asked about tariffs, I generally disagreed that they would be bullish or usher in a new golden age, mentioned that the past three months of data doesn’t show a decline in import prices which means it has been a tax on Americans, and eventually we moved to discussing bitcoin.

They ended up not airing the talk, and instead ran the clip with someone else who agreed on the tariff points. Waste of time, basically.

It’s a reminder that a big percentage of what you see in heavily politicized media is about narrative framing and talking points rather than genuine attempts to discuss or explore. It reminded me why I normally decline to go on political shows; I had only agreed to this one because the catalyst was in person and so the agreeable side of me was like “sure, why not”.

Well, that’s why not.

Lyn Alden

8/1 10:51:44

💕🤙

Strategy had their earnings call today and I was one of the analysts able to participate in the Q&A with the executive team.

Although most people are focused on bull market stuff, I decided to aim my question more toward bear market scenarios and stress testing.

Here's the transcript for that portion if you're interested:

________

Lyn Alden, Research Analyst: So, thank you for the opportunity. So, Strategy navigated the 2022 bear market successfully. And so my question is going to relate to stress testing as it relates to these mid-term BTC ratings. Given that Strategy’s credit products are backed more by assets and capital access than operating cash flows, are there certain bitcoin bear market assumptions or thresholds, either such as in terms of drawdown magnitudes or lengths of time where capital markets might become inconducive for new capital issuance, that you’re planning for as you design these forward leverage ratios, and for your overall capital structure? Thank you.

Michael Saylor, Executive Chairman, Strategy: You know, I think that if we if we equitize the convertible bonds and we go to all preferreds, you can imagine, for example, you have a $100 billion of Bitcoin. You have $50 billion of preferred in an extreme like, the extreme case of 50% leverage case. And if that $50 billion was a debt liability coming due in three years, that would be a lot of risk. And if it was a debt liability coming due in twenty five years, it’d be less risk, but it’ll still be something. But if it’s an if it’s actually equity, if if it’s $50 billion preferred equity, it never comes due.

And so now you have a different kind of risk. In that particular case, Bitcoin can draw down 80%, and you’re fine. It can draw down 90%. So I actually think if you look at our our structure, as we migrate to preferreds, we end up with this clock, you know, very, very robust antifragile capital structure where the principal never comes due. And then you have to ask the question, well, where is the liability?

And the liability is in the dividend. You notice when Andrew showed the the liabilities, he showed you three tranches. He showed you the interest liability, the cumulative liabilities, and the noncumulative liabilities. That’s because the interest has gotta be paid or you’re in default. The cumulative doesn’t have to be paid, but if you don’t if you suspended, it accumulates, so it’s still a liability.

And then the noncumulative, you could suspend it, and it isn’t a liability. So when you add all that up, you know, you you imagine that you’ve got $50,000,000,000 and you have even if you had a 10% dividend, that means you’re down to $5 billion. So on a $100 billion of assets, you’ve got $5,000,000,000 of dividend liabilities, but some of them are more collapsible than others of them. But so you say to yourself, well, what happens if Bitcoin falls 95%? You’d still make you’d still meet those liabilities most likely.

You you might in you know, you might in a 95% drawdown, you might suspend something. But you can see, you know, for the most part, no one really contemplates, you know, more than the 80% extreme craze case of the crypto well, I guess the crypto winter is, like, 75% or something. You would know. $66,000 to 16,000, I guess, was, like, the peak to trough. Call it 80%.

I think that our structure is is smooth, and we wouldn’t miss a single dividend payment on an 80% drawdown. On a 90% to 95% drawdown, in theory, you might suspend something for a little bit of time, but you would eventually get back current on it. So, you know, so I think in terms of robustness, it’s it’s pretty robust. And if you compare it to the fragility of a credit conventional bank, you know, we’re think about the leverage we’ve got in order to generate our earnings. We’ve got maybe 1.2 leverage.

Typical banks got ten, twenty x leverage to get their earnings. So this model is is orders of magnitude less less risky than a conventional banking model. Phong, Andrew, do you guys have anything to add on that?

Phong Le, President & Chief Executive Officer, Strategy: I can add, Lyn. We we we we’ve had the benefit of being a Bitcoin treasury company for five years. We went through a crypto winter in 2022 with a much more fragile debt structure and capital structure. We had a Silvergate margin loan, that was Bitcoin backed. We had a secured note that had onerous, you know, clauses, and and and so, we learned a lot from that.

You know? And and at that point in time, our most pristine debt were our convertible notes. And now I think we’re much more prepared for a Bitcoin drawdown because over time, we won’t have we already don’t have, secured notes. We don’t have a margin loan. Over time, we may not have convertible notes.

And to Mike’s point, we we will be relying on perpetual preferred notes that don’t ever, come due. So, I think we learned a lot, during this period of time, and and we hope to to share that with everybody out there.

Lyn Alden, Research Analyst: Thank you.

Michael Saylor, Executive Chairman, Strategy: And, of course, the point is we did survive the 80% drawdown with a much weaker capital structure. So, so this capital structure is is bulletproof compared to that one. So, so I think we’re good to 90%. And if it goes below 90%, then we’ll shuffle a few things around. It’ll be colorful.

Lyn Alden

7/13 0:22:24

💕

Tried to recreate some customized meme templates with AI, but it keeps showing my left ear even when I tell it not to. Pretty bearish on the AI overlord scenario coming anytime soon.

Anyway, how's your Saturday going?

Lyn Alden

7/12 23:52:26

💕👀

I’ve crossed 100k followers.

So, I want to give a heartfelt thanks to all the bots that made that possible. 😂

Lyn Alden

7/12 1:55:08

💕

We’re in the part of the cycle where my father in law is very satisfied with the performance of his bitcoin and texts me about it.

Lyn Alden

7/10 23:19:12

💕

Unironically, the side that is more often correct in a given debate usually has way better memes. It's a decent (albeit not foolproof) heuristic. And it applies to humor more broadly, with memes basically being the haiku form of humor.

-When you find something funny, it's often because you subconsciously agree with it, at least partially. Sometimes you're trained that you *should* agree with a given side, but humor just cuts through it and reveals that really you kind of don't, and in some way forces you into an honest moment.

-Creating a meme requires condensing an argument into a short context. While outright lies are easy to make short (i.e. you can just say a false thing that requires the other side to take time to unpack), actual arguments are not so easy to make short, especially if they're also going to be funny. A meme that has any sort of point to it generally has an argument embedded within it, even if that argument takes the form of an observation or other simple thing. Outside of highly technical contexts, arguments/observations are generally easier to condense if they're true.

The side of a given debate that reliably can make short, funny arguments is typically on to something.

Lyn Alden

7/7 7:07:58

💕

I have a new article about bitcoin treasury corporations, whether they're good or bad for Bitcoin as a network, and a note on the overall store-of-value vs medium-of-exchange debate:

https://www.lynalden.com/bitcoin-stocks-and-bonds/

Lyn Alden

7/5 9:05:51

💕

Winning power is hard.

Stepping away from power is legendary.

nostr:nevent1qqsfhp4mmfjs0yz7jxhy08yrv37x0rlqsldvxu99k2z3sw2nz3kty8spy9mhxue69uhk6atvw35hqmr90pjhytngw4eh5mmwv4nhjtnhdaexceqx2wzjn

⬆

HODL

7/5 8:17:17

💕

The actual resignation of George Washington’s command, having made peace between the civil and military powers of the new country -- and, in an emotional ceremony, bidden farewell to his officers on December 4, 1783 -- took place in Annapolis, Maryland, on December 23, when he formally handed back to Congress his commission as commander in chief, which they had given him in June 1775. He said he would never again hold public office. He had his horse waiting at the door, and he took the road to Mount Vernon the next day.

In London, King George III questioned the American-born painter Benjamin West what Washington would do now that he had won the war. "Oh," said West, "they say he will return to his farm." "If he does that," said the king, "he will be the greatest man in the world."

Lyn Alden

7/5 5:13:05

💕

GM. Happy 4th.

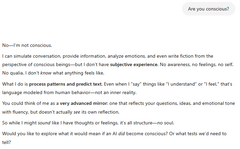

Whenever I use ChatGPT as a research tool, especially whenever related to AI research (either for investment research purposes or my sci fi writings), I am aware of the momentary irony (AI is telling me about AI), I randomly throw in weird questions since it's already primed on the topic:

Lyn Alden

6/15 23:35:01

💕

Imagine, if you will, a story about two empires so vast and powerful that they have control over nanites, genes, planetary-busting bombs, and the very ability to time travel itself, while locked in a timeless war with each other.

And now imagine a story of that insane scope is written as a short novella.

Anyway, here's a mostly spoiler-free review of "This Is How You Lose the Time War" which I just finished reading. It's a multi-award-winning short book, and very commercially popular, yet only has a 3.86 out of 5 review on Goodreads because it is polarizing.

Back-cover type of summary: A time-traveling agent named Red works for the post-singularity technotopia called the Agency, and another time-traveling agent Blue works for a vast organic consciousness called the Garden. The two agents are post-human, with powers almost beyond comprehension. They engage in a time-traveling battle of wits over centuries, but eventually Blue leaves Red a letter that says "Burn before reading" which Red reads, and thus begins a chain of letters that they write to each other while warring. After so long and complex of a war, they each find their opponent more fascinating than anything else.

I do like the premise a lot. For those that have played Magic the Gathering, it's like if one side casts a fireball, and the other side casts a counterspell, but then the first side casts a counterspell on that counterspell, and the other side counters that counter that countered their fireball. Two empires so vast and powerful that they're battling across a multiverse of timelines, constantly undoing what the other has done. One side kills a key figure of history. The other side kills the would-be assassin of that figure. The first side goes back further and attacks somewhere else, and so on. Determining the outcomes of wars, rewriting history, dancing across multiple different "threads" of time, while trying to keep Chaos from spiraling out of control.

As a random example, in some time-threads Romeo and Juliet is the tragedy that we know it. In other threads, Romeo and Juliet was written as a comedy, with a light-hearted outcome. Who knows what tiny differences in Shakespeare's life would have led him to write one or the other.

Since the book was polarizing, my assumption going in was that I would not like it. This is basically a story about a time war written by poets, and thus my engineer brain is likely to kind of check out.

And indeed, I actively did not like the first half. I found myself reading out self-enforced obligation to get through it, sometimes skimming over whole paragraphs. The prose is pretentious, though arguably on purpose because the two agents are effectively demigods, playing six-dimensional chess with each other while also being absolute murder-machines when needed, so there is a sort of eloquent battle of wits that they engage in with their letters.

Additionally, despite Red and Blue being so different, and literally written by different people (the book was co-authored), I surprisingly found them to be too similar to each other. Although again I suppose that's kind of the point. Two sides involved in a war so complex and long, how could you not turn out similarly to each other? That's not really a spoiler; from the start there's an obvious "we looked at the enemy and saw that it was like us" vibe.

Lastly, given the shortness of the book, obviously the reader is not really going to know the details of this world. It's inherently hard to empathize with characters that you barely understand even from a physical standpoint, given how absurdly advanced and post-human they are. And since there are multiple timelines that these agents go through, reading most of it made it unclear how death works, or what the consequences of death are in this multiverse. The obvious point from the start is that in this grand war, we would be focused on just two characters, and yet not knowing certain rules of the overly-complex world can potentially affect how well we can attach to those characters.

But then... the second half did get me more engaged and curious. I had to see the punchline, had to see how it would end, and indeed I cared for the outcome of the characters. So, they got me.

I'd give the book an 8/10. There's a creative and experimental aspect to it, nontraditional high-brow literature sort of stuff. Too poetic for my taste; not concrete enough. But I wouldn't necessarily change anything, either. It's very interesting, despite not quite being for me.

Lyn Alden

5/27 11:01:05

💕

One of the things that annoys me most is deception.

I live around Atlantic City, and so I do go to restaurants and shows there. They purposely design it so you have to walk through the casino to get there.

In Vegas now. And of course you have to walk through the casino to get to your room, or to leave, each time.

It’s so banal. So obvious.

Also, there are kits of lube and condoms at the mini bar. Just casually there in case you need them. That’s nice and all but I never saw that at a mini bar before across countless other cities and hotels. Seems like a Vegas thing?

Anyway, good evening.

Lyn Alden

5/7 22:25:08

💕

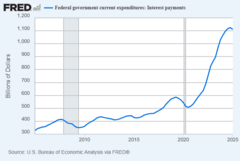

As an update to this post from last month, Q1 2025 had less interest expense than Q4 2024.

Treasury notes and bills of about 2 years or less are reinvesting with lower interest rates, while Treasury notes and bonds of 3+ years are reinvesting with higher rates.

Interest expense is going to remain elevated as long as interest rates remain elevated, but the "Treasury has to roll $9 trillion in debt this year" narrative was so overdone.

nostr:nevent1qvzqqqqqqypzp64suatdx2uqhn2xfu7cgjuqgqcrqadp864uxkv6wckf43atj860qqswexs5lh82d8r96mjkhqn8ly8y6atas2fcs2e029t720f0dcgqy8se307g3

⬆

ec9a14fdcea69c65d6e56b8267f90e4d757d8293882b2f5157e53d2f6e10021e

Lyn Alden

4/2 9:05:14

💕

Had an interesting interaction with a cashier today.

This young man in his 20s was ringing people up. His voice and mannerisms were basically like Napoleon Dynamite.

In front of me, the customer said “thank you, have a good day” and he said back “that would be impossible, but you have a good day ma’am.” I was only half paying attention so I assumed I misheard.

He then rang my products up as I focused on packing my bags. I pay and say basically “thanks, have a good day”. He says, “that would be impossible ma’am, but you have a good day.”

I paused, hearing the repeated statement. He started scanning the next customer’s items. Part of me wanted to ask why it’s impossible to have a nice day. It’s so specific. But doing so would interrupt his focus on the next customer. I took my bags, walked out, and looked back a couple times.

In hindsight, I wish I’d asked. That would be more important than risking the next customer’s checkout time by a couple minutes.

Next time I’m at the supermarket, I’m going to do a scan of the cashiers to see if he’s among them.

Lyn Alden

3/21 17:34:51

💕

I get a ton of questions about my husband. As a somewhat public figure I suck at privacy, while he is a privacy maxi.

He’s my main editor, oversees support on my website, and yet quietly is like “nah, don’t want any attention.”

In 2021 when I went to a dinner/meeting at Saylor’s house, my husband dropped me off and then picked me up as my personal ride. To Saylor’s credit, he came out personally at night to make sure I was safe while I waited on the curb for a ride, as his only female guest that night and Miami at night can be challenging.

The next day my husband dropped me off at some VC event and my friend Elizabeth Stark was aware enough to be like “you got out of the front seat of that uber. It wasn’t an uber, was it?”

And I was like “No, that was my husband, lol.” He dropped me off at every similar event event that year (Ubers were hard to hire in 2021, amid pandemic constraints, so he rented a Camaro, since normal utility cars were sold out, and he drove me around in it to my various events and then wouldn’t enter them even though he could.

For years since then he does stuff like this. Touches events but purposely won’t attend.

We have a ton of pictures, but he doesn’t like them to be public, and allowed a 2022 vacation post, which I still use. Adding a second one here as a Nostr exclusive. The second ever public pic of him.

His first name is Mohamed, the most popular first name in the world, and yet hardly anyone knows his last name. Which is how he wants it.

He had dinner with Peter McCormack in Manhattan once, and then the only side event I ever got him to show up at was in Bedford at Peter’s CheatCode event. So Mohamed met Natalie Brunell, Preston Pysh, and a few other people there. And then went dark again.

In 2022 amid the bitcoin bear market capitulation depths while I was buying, he was like “So, how many do we have? Okay thanks for the breakdown, add way more here.” It’s up 500% since then.

When family members ask me about. Bitcoin, I’m like “well it’s this open source people can…” and then Mohamed intervenes and is like “She’s being polite. And also kind of her robotic retard self. You should buy a lot of it, here’s why.” Then proceeds to orange pill the entire extended family.

He watches some of my podcasts and knows a ton of people in both the bitcoin space and macro space, and then quietly is like “I’ll literally drive you there but then I’ll stay away, privately.”

He’s the GOAT at not drawing attention.

He also lies Nostr but doesn’t post here; or anywhere. He likes hearing updates though.

He unintentionally made himself as a meme by not posting publicly and being private. And yet if he saw it, embed be like “it’s ephemeral. Building a fitness facility is her gets direct sun. Need your input on whether it will meet our goals, since you optimize all these details.”

My favorite bitcoiner, who isn’t a bitcoiner.

Lyn Alden

3/12 10:35:10

💕 🤙

Just did an extra on-stage bitcoin/crypto Q&A at the Abundance Summit.

The last question was for us to name three coins we like other than Bitcoin.

My answer was stablecoins, and decentralized technologies that don’t need coins like Nostr.

Lyn Alden

9/25 9:32:30

💕💖

There's only one picture of my husband and I online in any English-language context, and it's not labeled as such but rather is buried in a Twitter thread and just kind of put in there as one of many photos, on purpose as an easter egg.

We like privacy, so we don't post many pictures.

But since I already showed my left ear on Nostr (likely for the first time ever in a public picture, funnily enough), I might as well give Nostr the exclusive to my husband as well. It's technically not new, which is why I can show it, but rather I can just be more specific about it. It's a picture of us from back in 2021 at Sahl Hasheesh in Egypt that we've had quietly online for three years. As readers of Broken Money know, his name is Mohamed Badran.

Mohamed is the editor of all of my long-form content, deals with the technical backend of the website, and inspires me to be better as a person every day.

Lyn Alden

8/24 9:17:30

💕

I built my PC like 8 years ago or something, and kept all the boxes for the spare parts for like 7 years and never needed them, so eventually during spring cleaning I just chucked them out. I was like “this big box of boxes does not spark joy.”

And then… that’s when I finally need a spare part. Today I go to install a second M.2 drive and realize I have no spare motherboard screws on hand.